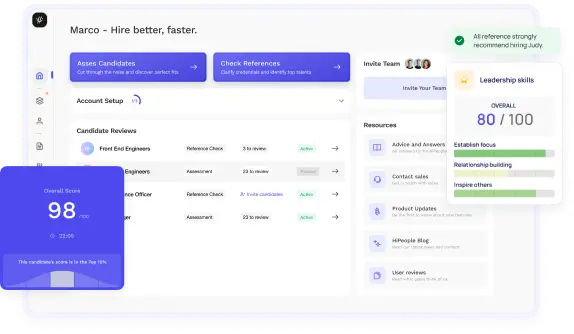

Streamline hiring with effortless screening tools

Optimise your hiring process with HiPeople's AI assessments and reference checks.

A Glassdoor survey revealed that 94 percent of employees seek benefits that significantly improve their quality of life, health, and well-being. Lifestyle spending accounts are a new employee engagement tool that offers flexibility and autonomy to employees while allowing organizations to set clear guidelines and stay true to their values.

The pandemic underscored the importance of workforce wellbeing, leading to significant investment and innovation in this area.

Although lifestyle spending accounts offer many advantages for both employers and employees, finding the right vendor can be challenging. Here are some key factors to consider when evaluating LSA vendors.

Lifestyle spending accounts are the latest employee engagement tool. They offer employees flexibility and autonomy while allowing organizations to set clear parameters and uphold their values.

These accounts are a versatile benefit that helps employers cover various types of expenses employees face in their daily lives. Since they extend beyond medical expenses, LSAs are meaningful to employees, enhancing retention and recruitment, boosting morale, and increasing employee engagement.

For example, an employer might provide a lifestyle spending account that employees can use for a range of expenses such as gym memberships, fitness classes, childcare, continuing education, or even wellness apps. Since these accounts cover more than just medical expenses, they are particularly meaningful to employees. This approach enhances retention and recruitment, boosts morale, and increases employee engagement by supporting various aspects of employees' lives.

Lifestyle spending accounts offer financial benefits that can boost your take-home pay and save you money on taxes. When you contribute pre-tax dollars to your LSA, you lower your taxable income, which means you get to keep more of your paycheck. Also, using the LSA for eligible expenses saves you money on taxes, as you avoid paying for these costs with after-tax dollars.

Lifestyle spending accounts significantly boost employee well-being by covering various expenses. These accounts can be used for fitness and wellness programs like gym memberships, yoga classes, and mental health services. They also support educational pursuits, allowing employees to pay for courses, certifications, and training programs that advance their careers.

Lifestyle spending accounts give employees the flexibility and autonomy to decide how to use their allocated funds. Whether it's investing in gym memberships, signing up for educational courses, or arranging childcare services, the choice is yours.

This level of autonomy makes you feel valued and understood, boosting your engagement and morale. When your employer trusts you to make decisions that suit your life, it creates a sense of empowerment and connection that enhances your overall well-being.

Giving employees perks like a lifestyle spending account can attract new talent and keep existing ones happy. It shows that the company cares about their well-being, making it a more attractive place to work.

Understanding how a Lifestyle Spending Account (LSA) works is essential for both employers and employees. For employers, it starts with setting criteria for who can join the program, considering factors like employment status and tenure. They then contribute funds, often based on employee salaries, which can be managed internally or through a third-party administrator.

Employees, on the other hand, get to decide if they want to participate during enrollment periods. They can contribute pre-tax dollars alongside employer contributions, keeping track of their expenses throughout the year and submitting claims for reimbursement. It's like having a personal budget for wellness and lifestyle needs. Also, some LSA plans may have a "use-it-or-lose-it" policy, meaning any unused funds at the plan year's end are forfeited. This highlights the importance of budgeting and planning expenses wisely throughout the year to make the most of the benefits offered by the LSA program.

Now, it's important to remember that each plan may have different rules, so it's worth understanding the specifics of your employer's program to make the most of it.

Note: When it comes time to cover these lifestyle spending account eligible expenses, employees can submit claims for reimbursement through the LSA platform or administrator. Reimbursements are typically processed via direct deposit or debit card, providing a convenient way for employees to access their funds. However, employees need to understand the tax implications of their LSA, as contributions may be subject to taxation while qualified expenses are typically tax-free.

Looking to enhance your employee benefits offerings with Lifestyle Spending Accounts (LSAs)? Look no further! We've curated a list of the top five LSA vendors and software solutions that are revolutionizing the way organizations support their employees' well-being. From seamless integration to customizable features, these platforms offer everything you need to implement LSAs successfully and empower your workforce.

Forma's Lifestyle Spending Account is a flexible benefit that lets employees save money for fun stuff after taxes. Employers choose who can use it, how much they get, what they can spend it on, and how they get their money back. Employees can use it online or get reimbursed for their expenses. Plus, it can fit into your company's budget and values, and it's easy to set up who's eligible with our LSA Eligibility Standards.

Employees have three options for spending their funds:

Key features:

Forma's Lifestyle Spending Account software comes with several key features:

Benepass LSA software allows employers to create customizable lifestyle spending accounts (LSAs) for their employees. LSAs are non-salaried allowances that employees can use for personal expenses, such as groceries, entertainment, and childcare. Employers can specify which items qualify for their employees' LSAs, such as wellness, diet, or mental health. Benepass LSAs can be used to attract and retain talent, cater to a diverse workforce, and save time and money.

Key features:

Benepass LSA software offers several key features:

JOON is a wellness benefits platform providing Lifestyle Spending Accounts (LSAs) for wellness expenses. With JOON's LSA software, employers can customize allowances, eligibility, and schedules for each merchant. Employees can easily link their bank accounts and personal cards to the platform for reimbursements and purchases, and they can upload receipts, which are automatically reviewed by the platform.

Key features:

JOON's LSA software offers some key features:

Clubhealth's LSA software is designed to manage Lifestyle Spending Accounts for employee wellness with ease. It allows employers to customize allowances, eligibility, and spending categories to fit their needs. Employees can conveniently access their LSA funds through a user-friendly platform. The software also offers features like real-time spending tracking and automated reimbursement processing. Plus, it integrates smoothly with existing HR systems for simplified administration. With Clubhealth, promoting employee well-being and managing benefits is simple and efficient.

Key features:

Clubhealth's LSA software offers several key features:

Espresa offers an easy-to-use platform called LSA Plus, where employees can access Lifestyle Spending Accounts (LSA) funded by their employers. With LSAs, employees can use either pre- or post-tax dollars to buy benefits tailored to their needs. These accounts are flexible, allowing customization and launching anytime, and have no minimum or maximum spending limits.

Key features:

Here are some key features of Espresa's Lifestyle Spending Account platform:

LSAs offer employees flexibility and autonomy in how they allocate their benefits, promoting a culture of empowerment and satisfaction within the workforce. Let's delve into the practical steps organizations can take to successfully implement LSAs for their employees.

LSAs can be seamlessly integrated into existing employee benefits packages. For example, let's consider a large corporation with a comprehensive benefits package that includes health insurance, retirement plans, and wellness programs. To integrate LSAs into their benefits offerings, the HR department can update the benefits enrollment portal to include information about LSAs.

Employees would log into the portal during the annual benefits enrollment period to review their benefits options. Alongside health insurance and retirement plan details, they would see information about LSAs, including how they work, the benefits they offer, and how employees can allocate funds.

Employers can conduct educational programs to familiarize employees with LSAs. For instance, imagine a medium-sized company launching a new Lifestyle Spending Account (LSA) program for its employees. The HR department organizes educational workshops to ensure that everyone understands how to utilize LSAs to their fullest potential.

During these workshops, HR representatives explain LSAs, including how they work, the benefits they offer, and the eligibility criteria. They walk employees through setting up their LSA accounts, allocating funds, and making eligible purchases.

Employers have the option to team up with LSA providers or leverage technology platforms that streamline the management and tracking of LSAs for their employees. This entails offering user-friendly apps or online portals where employees can conveniently monitor their LSA allocations and transactions.

In wrapping up, embracing Lifestyle Spending Accounts isn't just about perks—it's about creating a workplace where employees feel valued and happy. If the mentioned software doesn't meet your needs or if you want more options, consider HiPeople. Choosing the right staffing agency is important, but improving your hiring process with a robust talent assessment tool can also be a game-changer. That's where HiPeople comes in!

HiPeople is an AI-powered solution that helps employers assess potential employees' abilities. With over 300 evaluations in its Talent Assessment Library, including skills like Time Management, Technical SEO, and Figma Proficiency, HiPeople makes hiring decisions easier and helps build strong teams. Using HiPeople's insights, you can improve recruitment, streamline hiring, and unleash your workforce's full potential.