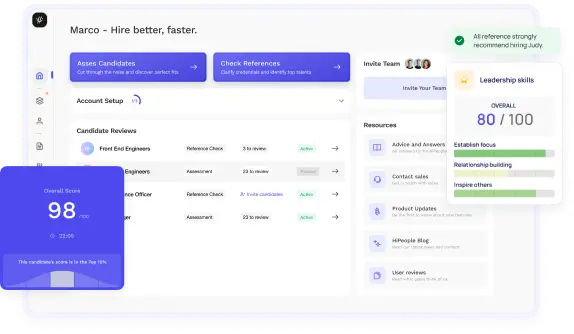

Streamline hiring with effortless screening tools

Optimise your hiring process with HiPeople's AI assessments and reference checks.

In small business management, where every cent matters and every minute saved is valuable, there is a frequently neglected tool in your toolkit - payroll service software. It is a powerful software that plays a vital role behind the scenes. A payroll processing tool is designed to turn the previously time-consuming and mistake-prone task of calculating salaries and taxes into a smooth and efficient process.

If you're a small business owner searching for the perfect payroll solution, you've come to the right place. In this blog post, we will explore payroll service software, explaining what it is and introducing the top five payroll software options that can simplify your life.

Additionally, if you are also looking for a robust talent assessment solution to hire talented employees and take your small business to new heights, we have the right solution. Check out HiPeople - an AI-powered talent assessment software with a large range of assessments and reference-checking features. It will help you find and evaluate the right candidate quickly and efficiently. That said, let's talk about the best payroll solutions for small businesses!

Curious about payroll service software? It's more than just another program - it's like having a reliable partner, a financial protector, and a time-saving expert specifically designed for your small business.

Simply put, payroll service software is a digital tool that streamlines the task of paying employees by automating and simplifying the process. It not only calculates salaries but also considers taxes, deductions, and other aspects. This can be a game-changing solution for small businesses.

Payroll software is designed to streamline the complex process of managing payroll, offering a wide range of features that can greatly simplify the life of a small business owner. Here are some of the essential features you can anticipate from payroll software:

Small businesses can gain several key advantages from implementing payroll software. Let's look at the major ones:

As a small business owner, time is incredibly valuable, and you have many responsibilities. One important task that can be automated to save time is payroll. Payroll software takes care of all the calculations, tax withholdings, and paycheck distributions much faster than manual or spreadsheet methods.

By using payroll software, you and your HR team can dedicate more time to important strategic tasks, such as growing your business, providing excellent customer service, or developing your employees. There's no need to get buried in payroll paperwork when there's an efficient solution available.

Although there is an initial cost associated with implementing payroll software, the potential savings in the long run are usually significant. By automating payroll, you can eliminate the need to hire extra staff or outsource payroll functions to external providers, thus saving money. Additionally, the decrease in errors, tax penalties, and legal complications can lead to substantial cost savings in the future. This allows you to allocate resources to other crucial areas of your business's expansion and progress.

Payroll mistakes can be expensive and result in unhappy employees. Payroll software reduces these risks by automating calculations, guaranteeing that your employees receive precise paychecks every time. It also aids in meticulous record-keeping of employee work hours and benefits, decreasing the chances of conflicts or extra work. By preventing errors, you can enhance employee contentment and minimize potential legal and financial troubles.

By integrating direct deposit into your payroll software, you can streamline the payment process for both your employees and yourself. Through this system, employees have the ability to conveniently set up their direct deposit preferences, guaranteeing that their paychecks are delivered electronically.

This eliminates the hassle of paper checks and manual distribution, consequently reducing the likelihood of payment delays. Not only does direct deposit provide convenience for your employees, but it also promotes environmental sustainability and cost-effectiveness for your business.

Accurately maintaining payroll records is essential for compliance, auditing, and reporting. With payroll software, historical payroll transactions are archived digitally, providing a valuable paper trail. This proves invaluable during tax audits or employee inquiries. Efficiently accessing and organizing payroll data can save you time and reduce stress when it comes to record-keeping and meeting regulatory requirements.

Small businesses must handle payroll management effectively, and choosing the right payroll software can have a significant impact. That said, let's explore five excellent payroll software options specifically tailored for small businesses.

As one of the most renowned payroll systems, QuickBooks hardly needs an introduction! It has been leading the payroll software industry for years and can act as the perfect payroll and account management solution for small businesses. QuickBooks has a variety of specially tailored plans that cater to the needs of new companies and startups, providing automation for taxes and employee payments.

Depending on the pricing option you choose, you can find multiple helpful features in QuickBooks. For example, you can access essential accounting features like monitoring income and expenses, optimizing tax deductions, generating comprehensive reports, and managing receipts.

The software also offers an Assisted Bookkeeping feature to help you manage your books and ensure every transaction is accurately recorded and maintained. As a small business with a limited workforce and resources, such features can be incredibly helpful.

Pricing: QuickBooks' prices start from $15 per month.

If you’re running a small business with shift-based teams—whether in hospitality, retail, healthcare, or manufacturing—Ordio offers a modern, easy-to-use payroll solution integrated directly into your workforce management system. With Ordio, you don’t need separate tools for time tracking, scheduling, and payroll. Everything flows together automatically, saving you time and reducing errors.

Ordio simplifies payroll prep by capturing exact working hours (including breaks, absences, and overtime) in real time. The system generates accurate, legally compliant payroll data you can export directly or integrate with your accounting software or tax advisor. No more manual calculations or Excel chaos.

Built specifically for businesses with dynamic staffing needs, Ordio ensures that payroll always reflects actual hours worked—without the administrative headache. It’s a streamlined solution for small businesses that want to run lean, stay compliant, and keep their teams paid correctly and on time.

Pricing: Starting at €89 per location/month.

If you're a small business owner looking for payroll and HR features in an easy-to-use package, OnPay is a great option. It stands out for its transparent pricing and affordability, making it a straightforward choice for small businesses. Once you have created your account, the software will handle all your tax filings and payments. They also provide an accuracy guarantee. If any mistakes occur, OnPay's team will assist you in resolving the issue with the relevant tax agency and bear the responsibility for any fines arising from the error.

Another excellent feature of this software is its unlimited payroll runs. The software lets small business owners create a pay schedule. However, you can even run payroll outside of it, such as for holiday or bonus pay. You have the flexibility to choose how to pay your employees, whether it's through direct deposit, paper checks, or prepaid debit cards. Additionally, OnPay offers pay-as-you-go workers' comp plans and automatically updates your policy when you hire new employees.

In addition to managing payroll, it also provides HR functionalities such as benefits management and employee self-service, making your business's overall human resources tasks easier.

Pricing: OnPay charges a base fee of $40 per month. You will also have to pay $6 monthly for every additional user.

Paychex, a renowned company in the payroll and HR sector, is an ideal option for businesses of any scale. Whether you have a small number of staff members or a constantly expanding team, Paychex provides the necessary adaptability and tailored solutions. From self-employed individuals to a team of over 1,000+ employees, Paychex offers top-notch payroll services for all kinds of companies.

Paychex stands out in its ability to support remote workforces. With its mobile payroll processing feature, you can conveniently handle payroll tasks from anywhere. This is especially advantageous for businesses with remote or field-based employees who rely on prompt and precise payment.

Some of the additional features that Paychex offers include round-the-clock customer service support based in the United States, management of workers' compensation, and human resource analytics. The software also offers you the convenience of submitting payroll over the phone. Furthermore, Paychex provides informative resources on its website to assist users in maximizing the benefits of the platform and streamlining the payroll process.

Pricing: Contact Paycheck's sales team to get a free pricing quote.

If you are short on budget and require affordable small business payroll software that doesn't compromise on features, check out Patriot Software! The software provides a payroll solution that is not only cost-effective but also offers a wide range of features. This makes it an attractive option for small business owners wanting to get the most value from their payroll software.

One of its standout features is automatic tax rate updates, ensuring tax law compliance. You can rely on accurate tax calculations, reducing the risk of errors and disputes. Setting up payroll is hassle-free with free setup, and you can choose between free direct deposit or printed checks for payment distribution. Customize your payroll to fit your needs and enjoy unlimited employee payrolls. This software streamlines your payroll processes and keeps your business running smoothly.

The software also lets you conveniently access various reports on your payroll processes. These reports include assigned deduction reports, W2 summary reports, and details of check/deposit payments. The user-friendly interface of the payroll system ensures easy access to the required information.

Pricing: The software offers a 30-day free trial facility. Pricing details are available upon request.

SurePayroll specializes in offering top-notch payroll and accounting services to modern-day small businesses. The software acts as your partner who understands your requirements and makes things easier for you. When it comes to managing payroll and benefits, regardless of whether you have one employee or several, SurePayroll fulfills all your needs.

SurePayroll offers a range of useful features, including automated tax calculations, direct deposit, and customizable reporting. It also includes handy tools for managing year-end tax forms and ensuring compliance with all tax obligations. With its focus on ease of use and dedication to keeping your business tax-compliant, SurePayroll is an excellent option for small businesses seeking to streamline their payroll processing.

One of the best things about Surepayroll that is hard to find anywhere else is that the software offers free services for up to 6 months! Yes, you read it right. So, if you are still on the fence, you can simply sign up for SurePayroll and try it out for free.

Pricing: Fill out the form on SurePayroll's website to get an instant pricing quote for free.

As a small business owner, you know how valuable your time is and how crucial it is to avoid costly errors. Using payroll software can address both of these concerns by eliminating tedious calculations and administrative tasks and reducing the risk of tax-related mistakes. Check out all the payroll solutions mentioned above and choose the ones that meet your needs and budgets perfectly!

However, if you are also looking for a tool for assessing talent and finding the right individuals to support your small business's growth, HiPeople is the perfect solution for you. With its extensive Assessment Library and automated reference check features, HiPeople makes finding the ideal candidate easier than ever before. For small businesses to thrive, having the right people is essential, and HiPeople offers a solution that can help you build the team you need. Sign up for HiPeople today!